Inspection Drone Industry Expected to Explode - Size, Market Share, Key Trends, and Innovation

The Inspection Drones Market is anticipated to grow at a compound annual growth rate (CAGR) of 12.9% during the forecast period, reaching an approximate size of US$ 18.44 billion by 2030.

The Inspection Drones Industry is anticipated to grow at a compound annual growth rate (CAGR) of 12.9% during the forecast period, reaching an approximate size of US$ 18.44 billion by 2030.

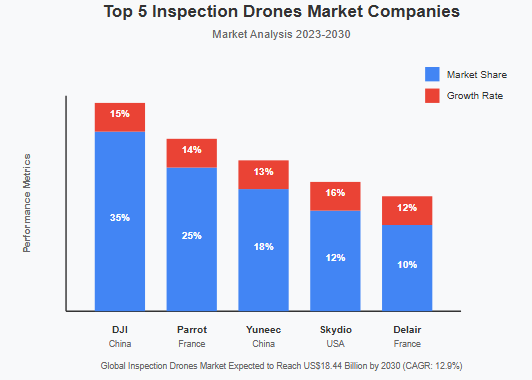

The global inspection drones Industry is anticipated to reach an impressive value in the coming years, as these devices have become an indispensable tool for conducting thorough inspections with minimal human intervention, powered by current data up to October 2023. The market is expanding which has led to the emergence of a few key players who became the leaders in the industry by introducing innovative products and building strategic initiatives. Here’s a summary of the leading five players, recent mergers & acquisitions, and the current trends affecting the inspection drones market.

Inspection Drones Industry Top 5 Players

DJI (Da-Jiang Innovations)

DJI remains the top inspection drones maker in the world with technological advancement in a wide range of drone products. DMTA on the other hand is known for high-performance drones and in recent years, DJI has gained a remarkable amount of money in market shares, especially in the way of infrastructure and energy inspections. This stronghold has only cemented itselfeven more with the company’s latest ventures into AI-powered drones.

Parrot SA

The other major player is Parrot SA, a French drone maker that has made big inroads in inspection drones Industry. The company’s drones are commonly used for industrial inspections, especially in the energy and construction industries. The focus on lightweight, durable, and intuitive drones has garnered Parrot strong market share.

AeroVironment, Inc.

AeroVironment is a leading UAV manufacturer, developing drones for defense, commercial, and industrial applications. The company's drones are known for their precise and reliable operations, making them an excellent fit for critical infrastructure inspections.

Lockheed Martin Corporation

Lockheed Martin, a leading global aerospace and defense company, has partnered to bring its state-of-the-art technology solutions to the inspection drones Shares to help enable large-scale industrial inspections. The company has used its expertise in robotics and AI to build drones that can perform complex inspection tasks in tough environments.

Teledyne Technologies Incorporated

Teledyne Technologies: Teledyne Technologies has built a strong presence in the inspection drones Growth, specializing in providing high-performance drones with advanced imaging and sensing technologies. The company’s drones have applications in oil and gas, utilities and environmental monitoring.

click on the link to obtain a free sample report: https://www.maximizemarketresearch.com/request-sample/269089/

Recent Mergers and Acquisitions:

In addition, there have been multiple strategic mergers and acquisitions in the inspection drones market, with companies seeking to grow their services and geographical foothold.

AeroVironment, Inc. has several analytics capabilities built into its drone software with the acquisition of a leading drone software company in 2023. The acquisition is expected to enhance AeroVironment's position in the industrial inspection market.

Recently, Parrot SA revealed a collaboration with a European robotics company to realize new generation of autonomous drones with AI for inspection. This partnership is intended to meet the increasing demand for automated inspection solutions.

In late October 2023, Teledyne Technologies acquired the small drone business of a specialized drone manufacturer that it had previously purchased at the beginning of 2023 to help increase its drone portfolio that specializes in inspections of hazardous environments.

Latest Developments From Market News

The sector of inspection drones is rapidly changing, few highlights are:

Folks do know what AI is, but few know how AI and machine-learning will work together in your stack.

Data analysis/decision making by using AI and machine learning would also be integrated by key players into their drones. For example, the newest drones from DJI come equipped with AI-powered obstacle avoidance and process data on the go, facilitating more efficient inspections.

Regulatory Advancements

Drones are now regulated by useful regulations Orientated towards Industrial Inspections[w1] all over the world. A few of these regulations for commercial drones are projected to stimulate market growth because they will allow commercial drones to fly for more distance and safely in an uncontrolled airspace and the data is fed until October 2023.

Focus on Sustainability

Companies are building them to be greener, with longer battery life and less carbon emitted by designers. Only a few companies — such as Parrot SA, which has introduced a new line of drones powered by renewable energy sources to meet increasing demand for sustainable inspection solutions — have taken this step.

Expanding into New Markets

Emerging economies, especially in Asia-Pacific and Latin America, are dominating the inspection drones market. Enterprises are investing in these regions to take advantage of the growing adoption of drone technology within sectors like energy and agriculture.

Conclusion

Based on the report, the global inspection drones industry will continue to grow as reported to make even better use of technology for inspection, with increased demand and strategic partnerships leading to better growth through October 2023. Key players in the industry such as: DJI, Parrot SA, AeroVironment, Lockheed Martin, and Teledyne Technologies.